how to calculate my paycheck in michigan

Monthly Tax Tables 2019 from. Plus you also need to factor in Michigans state unemployment insurance.

Free Paycheck Calculator Hourly Salary Usa Dremployee

For example if an employee receives 500 in take-home pay this calculator can be used to.

. Below are your Michigan salary paycheck results. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is.

How to calculate annual income. Just enter the wages tax withholdings and other information required. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

You can pay employees aged 16 to 17 at 85 of the minimum. For employees who are paid an annual salary gross pay is calculated by dividing their annual salary by the number of pay periods in a year. But these cities charge an additional income tax ranging from 15 to 24 for Michigan residents.

But calculating your weekly take-home. Michigan allows employers to pay 425 per hour for the first 90 days to train new employees aged 16 to 19. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

This Michigan hourly paycheck. The most popular methods of. Supports hourly salary income and multiple pay frequencies.

Below are your Michigan salary paycheck. Use ADPs Michigan Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

The results are broken up into three sections. Well do the math for youall you need to do is enter. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan.

This Michigan hourly paycheck. This free easy to use payroll calculator will calculate your take home pay. The Michigan Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Michigan State.

Use this Michigan gross pay calculator to gross up wages based on net pay. In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same flat rate of 425. So the tax year 2022 will start from October 01 2021 to September 30 2022.

How Your Paycheck Works. Below are your Michigan salary paycheck results. This differs from some states.

Calculating your Michigan state income tax is similar to the steps we listed on our Federal. To use our Michigan Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

It can also be used to help fill steps 3 and 4 of a W-4 form. The results are broken up into three sections. For example if an employee earns 1500.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Michigan. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is.

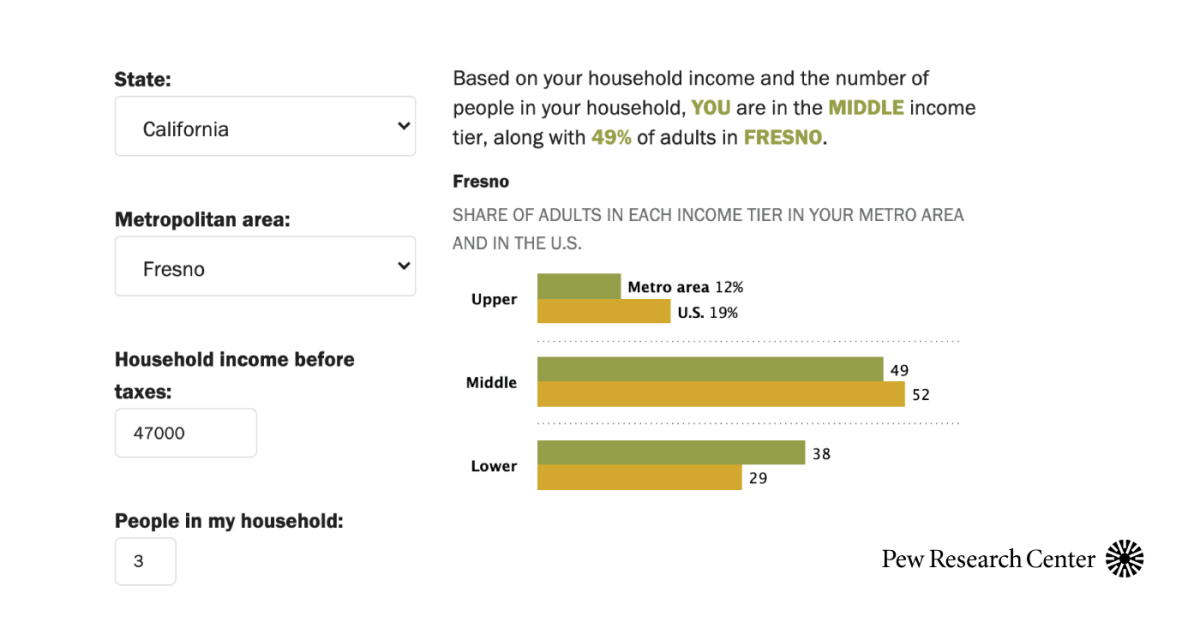

Are You In The U S Middle Class Try Our Income Calculator Pew Research Center

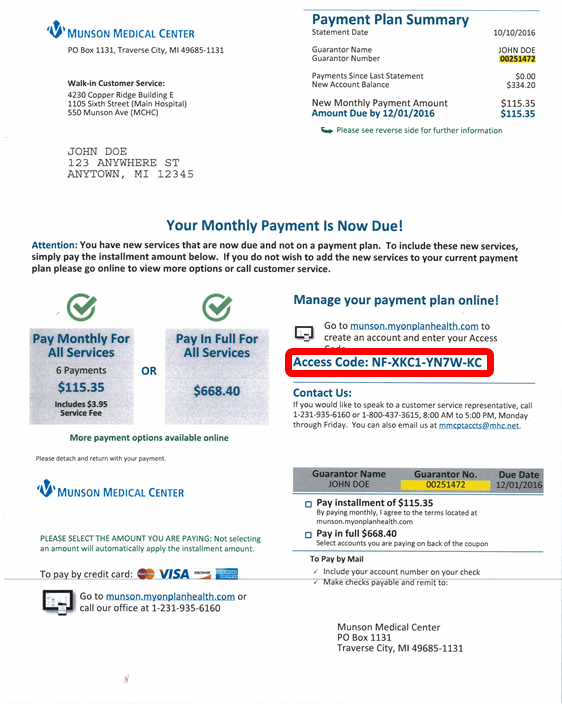

Bill Pay I Munson Healthcare I Northern Michigan

Leo Can A Person Work Part Time And Still Collect Ui Benefits

2022 Michigan Fall Colors Map When To See Michigan Fall Color Change Mymichiganbeach Com

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

This Quarterly Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Bookkeeping Business Small Business Accounting Business Tax

The Ultimate Guide To Michigan Real Estate Taxes

Michigan State Taxes 2021 Income And Sales Tax Rates Bankrate

Michigan Extra Food Stamps August 2022 Snap Deposit Schedule

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Bonus Calculator Percentage Method Primepay

Llc Michigan How To Start An Llc In Michigan Truic

Free Paycheck Calculator Hourly Salary Smartasset

Formula Updates And Shortage Information For Wic Clients

Michigan Sales Tax Guide And Calculator 2022 Taxjar

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference